Clerk Orr Releases 2014 Tax Rates

Cook County Clerk David Orr released the 2014 property tax rates for the county's more

than 1,400 taxing agencies on Thursday, the final step in the tax process before bills are

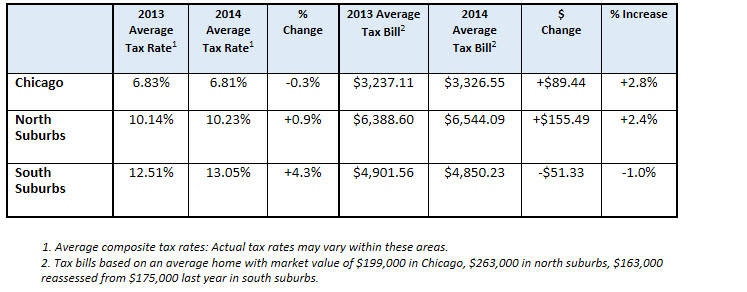

mailed out. The average homeowner in the city of Chicago and the northern suburbs will

see their tax bill increase slightly, while the average homeowner in the southern suburbs

will see a slight reduction in their tax bill.

In the south suburbs residential tax bills will on average be 1.0 percent lower. In north

suburbs there will be an average increase of 2.4 percent, and most Chicago homeowners

can expect an increase in their bill of 2.8 percent.

For the average single family home, this will translate to a decrease of $51.33 for south

suburban homeowners, an increase of $155.49 for north suburban homeowners, and a

property tax bill that is $89.44 higher than last year’s for Chicago homeowners.

Tax rates are calculated by dividing the amount of money each taxing agency or district

has requested in their levy by the total taxable value within each district. A taxing agency

or district is a body of government such as a school district, library, or municipality, which

levies real estate taxes.

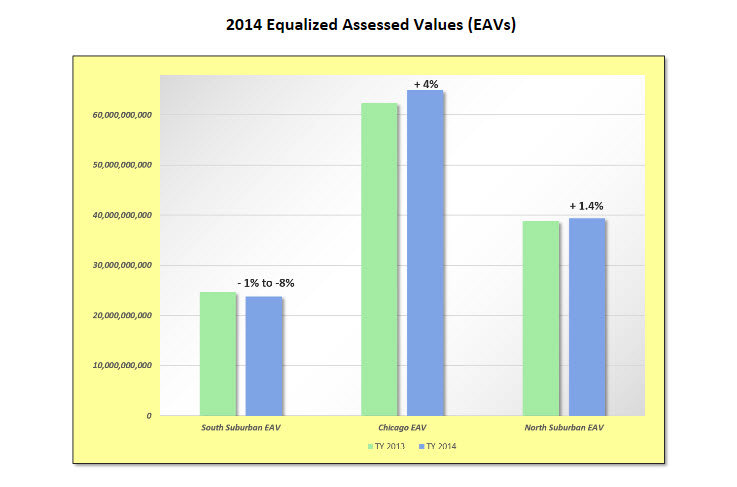

The overall equalized assessed value (EAV) in Cook County has increased 1.8 percent this

year, the first time values have increased since 2009. Values in the southern suburbs,

which were reassessed this year, continued to decline, while the northern suburbs and the

City of Chicago increased.

Decreasing values in the south suburbs have contributed to increases in 2014 property tax

rates for property owners, while tax rates for the north suburbs have increased slightly and

Chicago’s remained nearly flat. The rates will be reflected in the second installment tax

bills due August 3.

A significant factor affecting the City of Chicago's tax rates was the expiration of the Near

South Tax Increment Financing (TIF) District. The Near South TIF, located near the Lake,

south of Congress Parkway, is the second-largest TIF in terms of revenue in Cook County’s

history, collecting nearly $638 million over its lifetime. With the expiration of this TIF,

nearly $1 billion in taxable value has been returned to the taxing districts. This allows the

taxing districts to increase their levies without increasing tax rates as tax revenue previously

directed to the TIF can now be collected by the taxing districts. The expiration of this TIF

district could result in approximately $65 million in tax revenue that could be shared by Chicago

districts – such as the Chicago Board of Education and the Chicago Park District – without raising

tax rates.

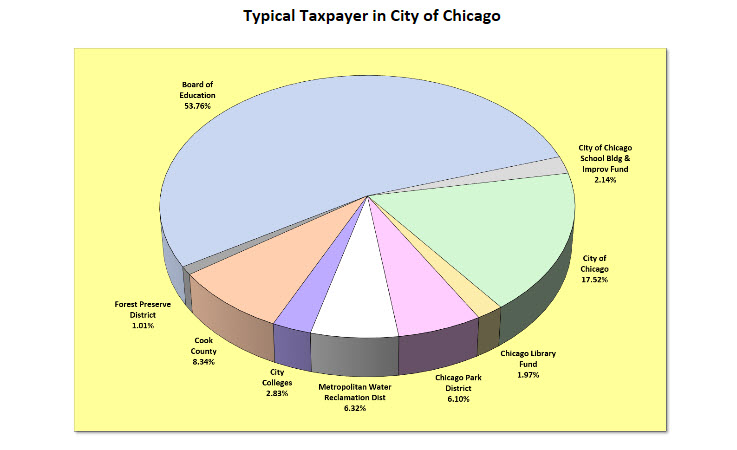

While City Colleges of Chicago only increased their levy by $1 million, other taxing districts with

property formerly within this TIF saw increased revenues without corresponding rate increases. The

Board of Education increased its levy by $86 million while its rate actually decreased 0.3 percent.

Of that $86 million, nearly half, $35 million, is due to the expiration of the Near South TIF.

The City of Chicago increased its levy 2.5 percent, bringing in $23 million more than last year while

reducing its rate by 1.5 percent. The Chicago Park District increased its levy 2.8 percent, increasing

their revenue by over $7 million, and like Chicago, decreasing their rate 0.3 percent.

The Metropolitan Water Reclamation District of Greater Chicago saw their rate increase 3 percent, having

increased their revenues $26 million, a 5 percent increase over last year, mostly due to an 8 percent

increase in their debt service for 2014.

"The nearly $1 billion in equalized assessed value that has been returned to the tax base with the

expiration of Chicago’s second-largest TIF district shows that taxpayers benefit when TIFs are allowed to

expire and their revenue shared," Orr said. "It illustrates how we need to keep taking a hard look at TIF

districts and work to pare down the number of TIFs, or at least the number of properties within each TIF

District."

Overall, tax rates have begun to level off after increasing steadily over the past several years, though

rates continued to increase in the southern suburbs due to declining EAVs.

As seen in the southern suburbs, an increase or decrease in the tax rate does not necessarily mean a

corresponding increase or decrease in individual tax bills. Individual tax bill amounts depend on multiple

factors including individual assessment increases or decreases, specific rate increases or decreases, and

applicable exemptions. A reduced rate applied to an increased value may result in a higher tax bill and vice

versa.

The equalization factor issued by the Illinois Department of Revenue has increased 2.4 percent from 2.6621 last

year to 2.7253 this year. IDOR calculates the factor needed to bring the total assessed value of all properties

in Cook County to a level equal to 33 1/3 percent of the total market value of all Cook County real estate.

The City of Chicago’s 2014 EAV increased 4.0 percent. Most of this increased value came from Chicago’s downtown

commercial district, where the EAV increased 10 percent due to the expiration of TIF districts, including the Near

South Tax TIF district.

EAVs in the southern suburbs declined between 1 percent and 8 percent in 2014. This is primarily due to triennial

reassessment reductions between 2 percent and 10 percent by the Cook County Assessor’s Office which offset the

increase from the 2014 Equalizer.

The 2014 EAVs in the northern suburbs increased an average of 1.4 percent. This modest growth in EAV is attributed

primarily to the 2.4 percent increase in the equalization factor, tempered by moderate reductions due to the property

tax appeal process.

The property tax rates for the south suburbs had the highest increase, at 5 percent, at the same time that rates in the

northern suburbs saw an increase of 1 percent, though rates vary considerably among jurisdictions. The City of Chicago’s

rates remained nearly flat, decreasing an average of only 0.3 percent.

The number of taxing agencies in Cook County has gone down nearly 4 percent, partly as a result of a cooperative initiative

between the Clerk’s office and municipalities to remove dormant Special Service Areas from the taxing district rolls. These

SSAs were not collecting taxes, but removing them has cleaned the rolls, taking the number of Cook County’s taxing districts

from 1,515 to 1,457.

The highest 2014 composite tax rate was 38.5 percent in the Village of Ford Heights and School District 169, where the average

home’s market value is $26,500. The lowest composite suburban tax rate – 7.2 percent – was in the Village of Barrington and Unit

School District 220, where the market value of an average home is $320,000.

The Alternative Homestead Exemption, commonly known as the "7 percent assessment cap" is now phased out in Chicago and the northern

suburbs. The maximum homeowner exemption in both of these areas is now $7,000. Although taxpayers in the southern suburbs were

eligible to receive a maximum homeowner exemption last year of $12,000, most were already at the $7,000 level because of declining

EAVs in the past several years. A small number of taxpayers in the southern suburbs were eligible to receive a larger homeowner

exemption in 2014. By tax year 2015, the Alternate Homestead Exemption will be completely phased out.

Countywide, $12,370,769,778 was billed in 2014, up 2.16 percent from $12.1 billion in 2013.

The Property Tax Extension Limitation Law (PTELL), also known as the "Tax Cap Law" limits the increase in revenue that districts may

collect to the rate of inflation. In most cases, districts this year were limited to an increase equal to the 2014 Consumer Price

Index (CPI) of 1.5 percent. Home rule districts, debt obligations, other special purpose funds, and value derived from new property

and terminated TIFs are exempt from this limitation. Next year, the CPI will limit tax revenues to an increase of 0.8 percent, the

second-lowest increase since the Tax Cap Law began over 20 years ago.